Buying your first home is an exciting milestone. It’s a chance to put down roots, build equity, and create a space that truly feels like yours. But for many first-time home buyers in Chattanooga, the process can also be overwhelming—and even costly—if they aren’t prepared.

So, what’s the biggest mistake first-time home buyers make?

Not being fully prepared before starting their home search.

Many first-time home buyers dive into the process without a clear budget, a strong financing strategy, or an understanding of Chattanooga’s competitive market. As a result, they may overpay, miss out on great opportunities, or end up in a home that doesn’t meet their long-term needs.

But here’s the good news: With the right knowledge and strategy, you can avoid these pitfalls and make a smart, confident purchase. In this guide, we’ll break down the most common mistakes—and how to sidestep them—so your home-buying journey is smooth and successful.

Understanding the Home Buying Pitfalls

Buying a home isn’t just about finding a property you love—it’s about making a sound financial decision that will serve you well for years to come. Unfortunately, many first-time home buyers make missteps that can lead to stress, unexpected costs, or even regret.

Let’s explore the three most common categories of mistakes first-time home buyers make and why they happen.

Financial Mistakes That Can Cost You

Before you even start house hunting, your financial foundation needs to be strong. These are some of the most common—and costly—errors first-time home buyers make:

Emotional and Strategic Mistakes

Buying a home is an emotional experience, but letting emotions drive your decisions can lead to regret. Here are the biggest traps first-time home buyers should avoid:

- Falling in Love With a House Before Knowing Your Budget

It’s easy to get attached to a home at first sight. But without knowing what you can afford, you risk disappointment—or worse, overspending on a home that stretches you financially. - Skipping the Home Inspection

In competitive markets, some first-time home buyers waive inspections to make their offer more appealing. But this is risky—hidden issues like structural problems, outdated wiring, or plumbing issues can turn into costly surprises. Even if you’re buying new construction, an inspection is a must. - Rushing the Process

Chattanooga’s market moves fast, and it’s easy for first-time home buyers to feel pressure to make quick decisions. However, skipping key steps—like reviewing the neighborhood, assessing resale value, or comparing mortgage options—can lead to long-term regrets.

Market-Specific Mistakes in Chattanooga

Chattanooga is a unique market with its own challenges and opportunities. Many first-time home buyers overlook these key factors:

- Not Considering Location Beyond the Neighborhood

A home’s value isn’t just about the property—it’s also about:- Commute times

- School district quality

- Nearby development plans

- Flood zones and insurance requirements

- Underestimating Competition in Hot Areas

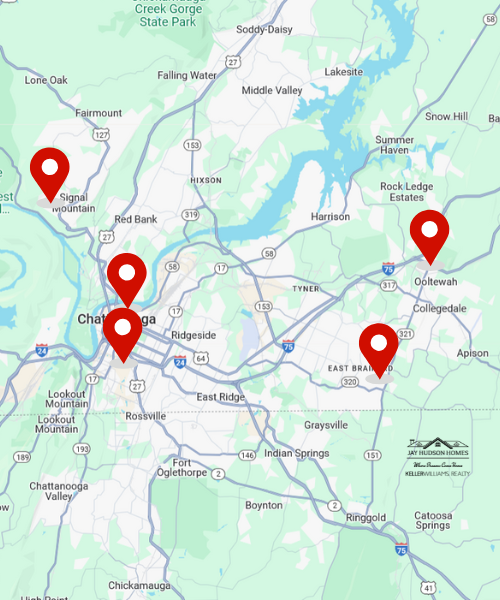

Popular neighborhoods like North Shore, Southside, and Signal Mountain see strong demand. If first-time home buyers aren’t prepared with a solid offer strategy, they may lose out to more competitive buyers. - Assuming New Construction Is Flawless

Many first-time home buyers believe that a newly built home means no problems. But even new homes can have construction defects, so it’s crucial to get a third-party inspection.

The Reality of Home Buying in Chattanooga

Now that we’ve covered what can go wrong, let’s talk about why these mistakes happen—and how Chattanooga’s market plays a role.

Chattanooga is a Competitive Market

While home prices remain more affordable than in many larger cities, demand is strong in certain neighborhoods. Homes in desirable areas can receive multiple offers, meaning first-time home buyers need to be financially prepared and ready to act fast.

Interest Rates and Loan Terms Fluctuate

Many first-time home buyers wait too long to lock in a rate or don’t explore different loan options. Even a slight increase in rates can significantly impact monthly mortgage payments.

Buyers Often Overlook Negotiation Power

A great Realtor can help first-time home buyers negotiate not just price, but also closing costs, contingencies, and repairs. Without guidance, buyers may leave money on the table.

How to Avoid These Mistakes & Buy Smart

You’ve seen the pitfalls—now let’s talk about how to get it right. Here’s your blueprint for a smooth home-buying experience.

Get Financially Ready First

- Get pre-approved, not just pre-qualified. This strengthens your offer and gives you a clear price range.

- Understand the full cost of home ownership. Budget for taxes, maintenance, and unexpected expenses.

- Buy within your means. First-time home buyers should choose a price point that leaves room for savings and lifestyle expenses.

Be a Strategic Buyer

- Research neighborhoods thoroughly. Consider commute times, school districts, and future developments.

- Never skip a home inspection. Even in a competitive market, an inspection can save you from costly surprises.

- Craft a competitive offer strategy. Work with your Realtor to navigate multiple-offer situations wisely.

Work with an Expert Realtor

Finding a Chattanooga market specialist is essential for first-time home buyers who want to navigate the local real estate landscape with confidence. A knowledgeable Realtor understands pricing trends, negotiation tactics, and which neighborhoods best fit your lifestyle and budget.

Beyond their market expertise, an experienced Realtor also brings a network of trusted professionals to the table. From reputable lenders who can secure the best mortgage rates to thorough home inspectors and skilled contractors, having the right connections ensures a seamless and stress-free home-buying process.

Take the Next Step Toward Smart Home Ownership

Avoiding these mistakes means making informed choices from day one. The right preparation ensures first-time home buyers find not just a house, but a home that meets their financial and lifestyle goals.

Ready to start your home search the smart way? Jay Hudson Homes – Keller Williams Realty is here to guide first-time home buyers through every step—from securing financing to negotiating the best deal.

Frequently Asked Questions

What hidden costs should first-time home buyers be aware of?

Beyond the purchase price, you should budget for closing costs (2-5% of the home’s price), property taxes, homeowners insurance, HOA fees (if applicable), and ongoing maintenance.

How much should I budget for a down payment?

Many loan programs allow as little as 3-5% down, FHA and VA even offer 0% down. However, a larger down payment can lower your monthly payments and overall loan costs.

When is the best time to buy a home in Chattanooga?

The market fluctuates, but spring and summer are peak seasons with more inventory, while fall and winter can offer less competition and potential deals. A Realtor can help you determine the best timing based on your goals and budget.